RETIREMENT SOLUTIONS

401(k) Retirement Plans

Empowering employees and strengthening retention.

A 401(k) plan is the most common “defined contribution” workplace retirement plan in the private sector. It is an employer-sponsored retirement savings plan into which employees allocate a portion of their pay, subject to IRS annual limitations. As sponsor and employer, you may choose to match all or a portion of your employee contributions.

According to a recent analysis from the US Bureau of Labor Statistics, 41% of companies that provide a 401(k) plan offer employer matching contributions, typically up to 6% of employees’ salaries. Only 10% of these companies go beyond the 6% mark, with the top/larger employers matching contributions up to 25%.

Our local 401(k) plan administration experts can work with you to ensure your retirement and benefits plans fit your short- and long-term needs and budget. With Daybright, you have more options. Simply.

All of our 401(k) plans include:

- Open architecture portfolio — thousands of funds to choose from

- Professionally managed model portfolios

- No proprietary fund requirements

- Zero revenue-sharing funds

- Trusted custodial partners: Charles Schwab, MG Trust (Matrix), Fidelity, Mid-Atlantic

- 360 payroll integration

- Easy online enrollment, with comprehensive support

- User friendly management technology

- Straightforward pricing — no hidden cost

- Options for fee- or commission-based arrangements

- Comprehensive compliance and fiduciary support

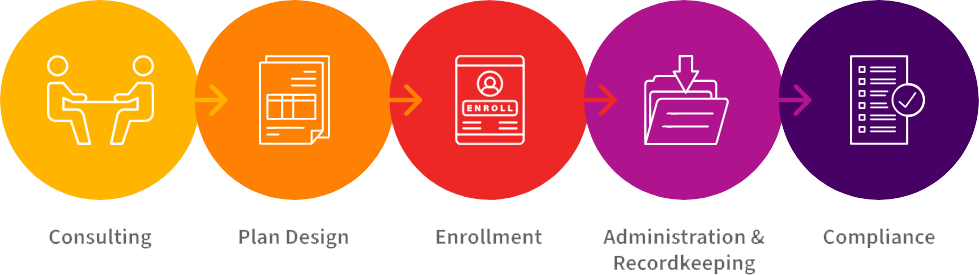

Our process covers all the services you need:

We’ll save you time and effort in choosing and offering your plan and, ensure it continues to operate as cost efficiently as possible.