RETIREMENT SOLUTIONS

FICA Alternative (OBRA Plans)

Cost savings and retirement benefits for part-time employees.

A FICA Alternative plan is a retirement plan for seasonal, part-time, and temporary governmental and school district employees. Employers may avoid up to the matching 6.2% Social Security contribution, replacing it with an impactful benefit for employees.

FICA is a U.S. federal payroll tax. FICA is another name for Social Security payments.

This plan allows you to substitute Social Security payments with a private investment plan for your part-time, temporary, and seasonal employees. Contributions to the plan are deducted from employees’ wages. They are income tax-deferred and invested in accordance with employees’ direction and objectives.

Benefits to you:

Like Special Pay Plans, you save Social Security taxes — but Medicare taxes are still required.

Benefits to your employees:

Employees in a FICA Alternative (OBRA plan) can choose from a wide variety of savings and investment options, and their accounts grow income tax deferred. This means greater control of retirement funds upon termination, death, disability or normal retirement age. 7.5% of employee wages are contributed on a pre-tax basis.

Meet John

John is a part-time employee for his local school district. Because his school district has a Daybright FICA Alternative Plan, he now has a contribution going into his retirement plan in his name with no impact to his take-home pay, a benefit he would not have had otherwise. Here is how the plan works:

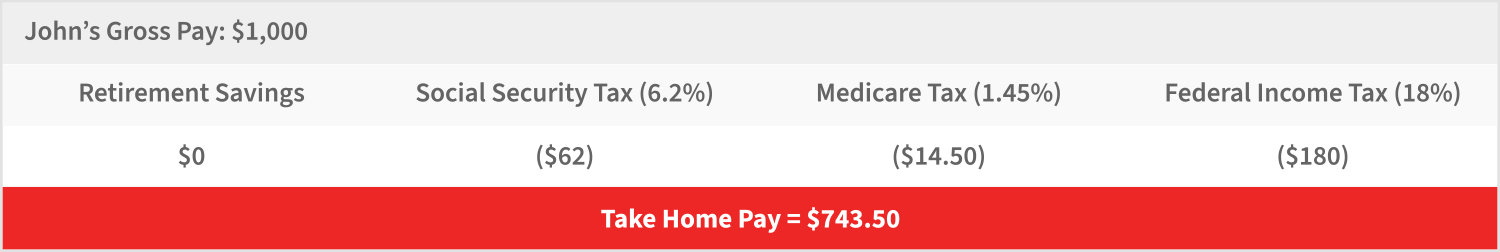

Without Daybright’s FICA Alternative Plan

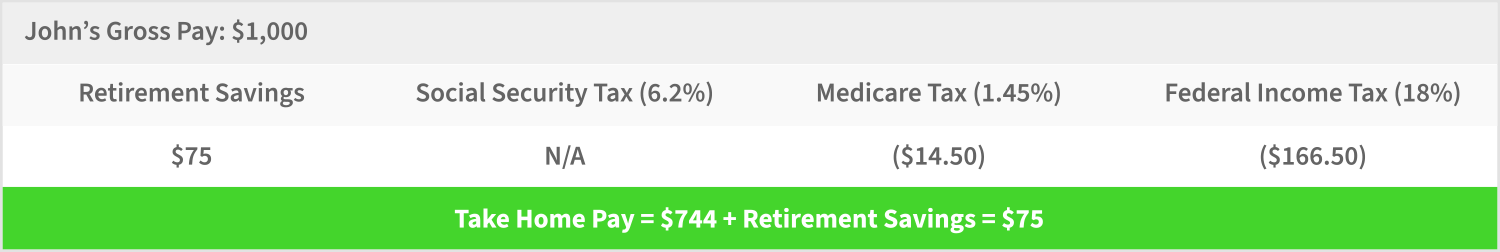

With Daybright’s FICA Alternative Plan

Takeaway: John’s take home pay increases and he’s saving for his retirement!